Power of Attorney: Part 2 => What You Need to Know

November 18, 2016

I recently explained the basic “What” and “Why” to provide a basic understanding of the Power of Attorney document and why it’s extremely important for every family.

I also shared a story about Joe and Doreen, a married couple without a Power of Attorney, to demonstrate how and why a POA can come into play (and how it can critically affect families).

Basic Powers Granted in a Power of Attorney

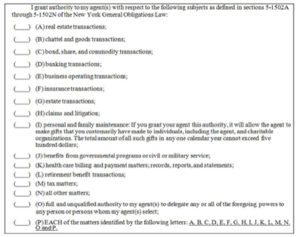

With this example in mind, let’s examine the basic powers that your agent receives when a Power of Attorney has been signed. The illustration below lists the various powers that are available to be assigned your agent:

Most individuals are asked to initial Item ‘P’ which grants their agent the authority to use all of the powers that are listed. Prior to initialing Item ‘P’, you should fully understand what each of these items entails. Although some of the powers are relatively self-explanatory (i.e. real estate transactions, banking transactions, etc.), categories like “chattel and goods transactions,” “tax matters” and “all other matters” should be explained in detail by the attorney draftsperson of the document.

While this list is non-exhaustive, here is a quick explanation of each category. Please keep in mind that this list is not all inclusive and your attorney draftsperson should always explain these categories in further detail prior to the signing of the document:

- Real estate transactions – agent has authority to buy, sell and gift real property; agent may release, assign or satisfy a mortgage or lien on said piece of real property; agent may manage said property and may also obtain various forms of land owner insurance; agent may enhance or modify real property (i.e. build, replace or remove structures).

- Chattel and goods transactions – agent has authority to buy, sell and gift personal property (i.e. automobiles, jewelry, clothing, etc.); agent may release, assign or satisfy any liens on personal property.

- Bond, share, and commodity transactions – agent has authority to buy, sell, surrender, loan, etc. any bonds, shares, instrument of similar character, commodity interest or any instrument with respect thereto;

- Banking transactions – agent has authority to open and close any type of bank account; agent may change the title of any account; agent may make withdrawals and/or deposits on account; agent may issue checks from bank accounts; agent may receive bank statements, borrow money by bank overdraft and/or promissory note and/or apply for or receive letters of credit or travelers checks;

- Business operating transactions – with respect to business enterprise that is owned by the principal, agent may continue, modify, renegotiate and terminate any contractual arrangements made with any person, firm or association; agent may determine nature and extent of business operation, amount and type of insurance carried by the business entity and compensation of attorneys, accountants, etc.; agent may change the form or organization under which the business operates and enter into partnership agreements or corporate agreements; agent may authorize corporate takeovers; agent has authority to sign all papers on behalf of business, contest any tax proceedings, and otherwise manage said business;

- Insurance transactions – agent has authority to pay all premiums, terminate policies and procure new policies; agent may apply for and receive any available loan on the security of the contract of insurance; agent may surrender said policy in order to receive the cash surrender value of same; this authority shall not include the power to add, delete or otherwise change the designation of beneficiaries in effect for any such contract, unless the authority to make such additions, deletions or changes is conveyed in a statutory major gifts rider to a statutory short form power of attorney;

- Estate transactions – agent may act in place of principal who has been named as executor / administrator of estate; agent may apply for and procure letters of administration, letters testamentary, letters of trusteeship or any other fiduciary authority in the name of the principal;

- Claims and litigation – agent has authority to represent the principal’s interest in any legal claims and/or litigation that may be taking place or will be taking place in the future;

- Personal and family maintenance – agent has authority to do all acts necessary for maintaining the customary standard of living of the family of the principal including providing family with living quarters, vacations, use of usual educational facilities, medical care, dental care, surgical care, etc.;

- Benefits from governmental programs – agent has authority to apply for governmental benefits on behalf of principal and may also negotiate said benefits on the principal’s behalf.

- Health care billing and payment matters – agent may access records relating to the provision of health care and to make decisions relating to the past, present or future payment for the provision of health care; please note that this authority does not include authorization for the agent to make other medical or health care decisions for the principal.

- Retirement benefit transactions – agent has authority to contribute to, withdraw from and deposit funds in any type of retirement benefit or plan; agent may make investment decisions and may also make rollover contributions from any retirement benefit or plan to other retirement benefits or plans; this authority shall not include the power to add, delete or otherwise change the designation of beneficiaries in effect for any such contract, unless the authority to make such additions, deletions or changes is conveyed in a statutory major gifts rider to a statutory short form power of attorney;

- Tax matters – agent may prepare, sign and file federal, state, local and foreign income, gift, patrol, federal insurance contributions act returns and other tax returns, claims for refunds, requests for extension of time, petitions regarding tax matters, and any other tax-related documents on behalf of principal; agent may designate another person to represent principal in all tax matters; agent has authority to pay all taxes due, collect all refunds and receive all confidential tax data;

- All other matters – principal authorizes the agent to act as an alter ego of the principal with respect to any and all possible matters and affairs which are not enumerated in the previous sections; provided, however, that such authority shall not include authorization for the agent to designate a third party to act as agent for the principal or to make medical or other health care decisions for the principal; and

- Delegation authority – agent may, via a written, signed statement, delegate his/her authority to a third party as the agent sees fit; this provision is useful in the event that an agent may be leaving the area/country for a short period of time and would like someone else to serve as agent during the period of their short absence.

In the third and final part of this blog series, I’ll examine important modifications your attorney should make to your Power of Attorney to ensure all your bases are covered should you or a loved one require skilled nursing care.

But you don’t have to wait for Part 3 to get started on your Power of Attorney. Give me a call with any questions or to get started on your document.

Related Topics: Estate Planning

« Back to Blog